Bitcoin exchanges are the focal point of the commercial landscape. They provide an entry point for adopters and liquidity for speculators to adjust their positions. There are several main exchanges into Bitcoin and the landscape changes often. In the currency’s short history we have had different market structures and behaviours as the currency vies for maturity. Many speculators are familiar with operational issues and failures but despite innovation, the entry and exit into Bitcoin remains a challenge.

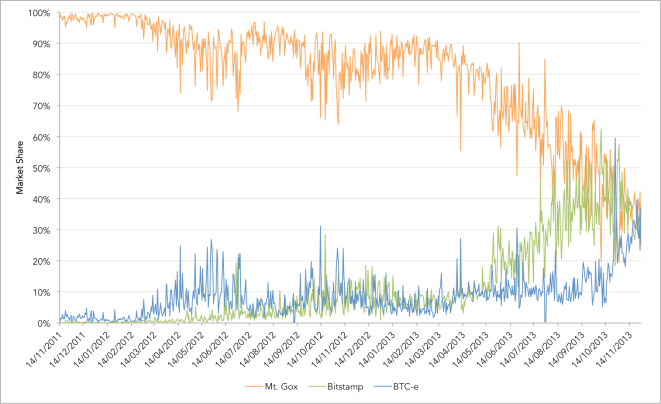

In 2010, when there were little transactions being done on the Bitcoin network, Mt. Gox, an exchange that had facilitated trade between previous virtual currencies, offered the first BTC/USD exchange platform. It retained a large market share until it began to lose its monopoly in November 2011. The chart below shows the rise of its two rival exchanges Btc-e and Bitstamp. The market share is calculated using the daily average volume of Bitcoins traded on the exchanges.

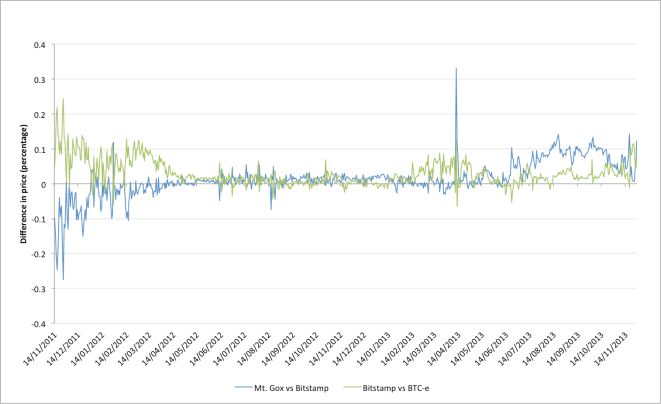

Market shares have clearly been in flux and so too have the price differentials between the exchanges. Bitcoin has been shown to disobey one of the cardinal rules of economics, the law of one price. When the same product is bought and sold in several markets, the prices in all markets should converge due to arbitrage opportunities. From May 2013 until October 2013, Bitstamp made considerable gains against its competition moving from accounting for less than 20% of the market to over 50% at times during September 2013. During this time, a price differential also opened up rising to a high of about 15% in September 2013. These trends had a common cause, a legal battle which resulted in Mt. Gox suspending all transfers to the USA. On May 15th 2013 , the US Secret Service and Department of Homeland Security seized $5 million in relation to Mt. Gox’s activities. They seized funds from three US bank accounts. Two of which were in the name of Mt. Gox’s US subsidiary and a personal account of the CEO of Mt. Gox. The redemption suspensions have meant that the price on the Japanese Bitcoin exchange trades at a premium to Bitstamp.

In May 2013, Coinlab filed a $75 million lawsuit against Mt. Gox for failure to uphold an agreement signed in 2012. The agreement gave Coinlab exclusive rights to handle Mt. Gox’s North American clients. According to the lawsuit, Mt. Gox never turned over the necessary materials required to facilitate the transition, such as access to client account information. Mt. Gox claims that Coinlab did not fulfill the necessary regulatory requirements. The litigation is on-going. Partially in reaction to the case there is set to be a large proliferation of new exchanges launched in the third quarter of 2013.

Price differentials are interesting and profitable for arbitrageurs but remain challenging and perplexing for users and new adopters. Here at Coinometrics, we seek to bring some clarity in understanding this crucial market and are developing statistics to keep track of new developments. In my next post, I will explore the differences in the exchanges and look through the ways in which obtaining bitcoins on the different exchanges is not a homogenous good and hint at possible explanations for price differentials.